January 20, 2009

by Marsha W. Johnston, Contributor

California, United States [RenewableEnergyWorld.com] Everyone knows the wonders that commercial power purchase agreements (PPA) worked in boosting commercial solar sales over the last couple of years. In fact, the latest report from the AltaTerra Research Network says about 72% of nonresidential solar market sales in 2008 were attributable to third-party finance and PPAs from industry titans like SunEdison.

What is less well known is that the same instruments, which were introduced into the residential sector in late 2007 and spring 2008, are driving a demand in California that appears quite resistant to the nation’s current economic morass. The most notable programs are the SolarLease from Foster City, CA-based Solar City and the residential PPA from SunRun Inc., of San Francisco.

“The market has really shifted from early adopters buying and owning the system to mainstream customers who just want to buy the power,” says Arno Harris, CEO, Recurrent Energy, a commercial PPA provider. “Residential [solar] is becoming like the auto industry, where you buy a US $20,000-$30,000 system and spread it out over time.”

The biggest difference between Solar City’s SolarLease and SunRun’s PPA, which is provided by installers REC Solar and Borrego Solar, is the upfront cost.

Customers for SunRun’s PPA must make a pre-payment to buy down their rate for power, which typically comes to 18 years worth of power at US $0.135 per kilowatt-hour (kWh), or between US $8,000-$12,000, approximately 30% of the usual system cost, says SunRun co-founder and president Nat Kreamer. He adds, however, that customers can get SunRun “for as little as a US $2,000 pre-payment for electricity.” (See related press release.)

In contrast, Solar City customers pay little or no upfront charge for the SolarLease.

The two approaches also differ in their monthly payment practices. A SunRun PPA monthly payment varies each month based on the production of the system, whereas the SolarLease payment does not change month to month, but increases 3.9% per year. The SolarLease monthly payment comprises the panel lease charge plus the lower electricity bill, and typically comes out to a savings of approximately US $10 per month.

At the time of sale, both Solar City and SunRun calculate what the system should produce. If the system over produces, both companies sell power back to the utility. In both cases, if a system under produces, the firm refunds the shortfall to the customer.

“SunRun’s interests are actually more aligned with the customer’s than are a typical solar lease program,” says SunRun’s Kreamer. “With a lease, the customer is paying for the panels no matter how they perform or how much energy they generate. With SunRun, a customer only pays for the power the panels produce, and if the panels don’t meet the output guarantee, SunRun will refund the customer’s electricity bill payment. SunRun only makes money if the customer gets his or her power, which is a much better deal for homeowners than a fixed-rate lease.”

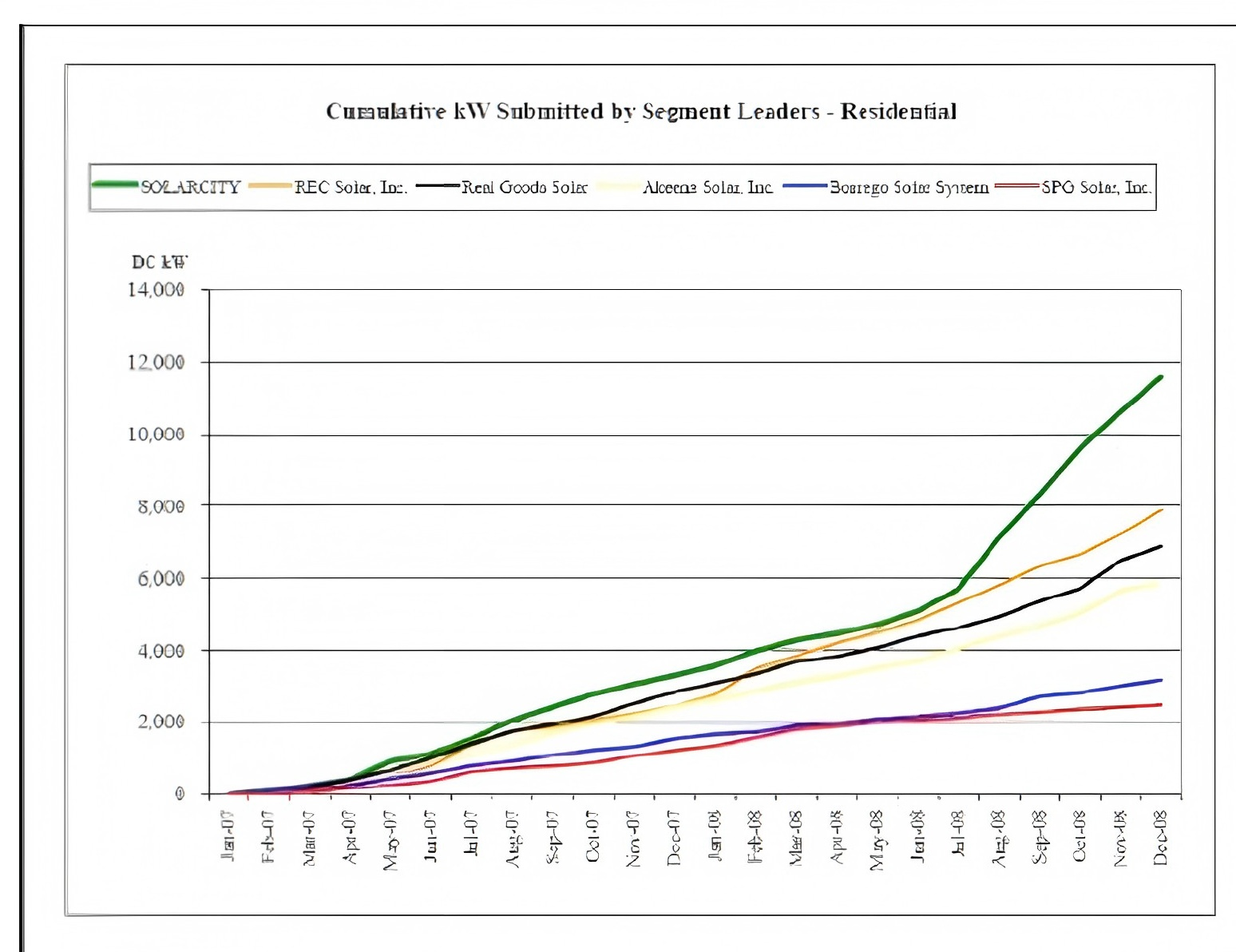

Kreamer’s argument makes sense, but recent California Solar Initiative figures (see chart, below) for cumulative residential sales of the state’s top 6 solar integrators indicate that the SolarLease (the green line) is attracting bigger numbers of residential solar customers than is SunRun’s PPA.

All residential sales have continued to climb since spring of 2007, but none more steeply than Solar City’s. Since July 2008, about 3 months after it introduced the SolarLease, Solar City’s growth curve went practically perpendicular. “July is always our number one month for sales. But this year, to date, year to year, we were up 300%, and July alone was up 600-700% year to year,” says Lyndon Rive, Solar City CEO.

And Solar City’s steep growth continued through the final months of 2008, as the economy tanked. “October customer numbers were higher than September. We were surprised because the winter months are slower than the summer months. Combined with the economic collapse, one would expect our solar sales to decrease dramatically,” says Rive.

Adoption in November and December for Solar City was lower month to month, but December was nonetheless up 300% over December 2007, he added. “In difficult financial times our customers look for ways to save money. With SolarLease they save money from day one with no investment, so this is an easy decision. If you give people the option of clean power and dirty power and to pay less for clean, they will choose clean,” Rive says.

SunRun’s offering has also done well, though the company would not provide exact figures. REC Solar, which serves as SunRun’s installer, had the second-steepest growth after Solar City, while Borrego’s is more modest. “SunRun allows customers to lock into a low, FIXED electricity rate for eighteen years. This is probably the most attractive feature for people worried about the rising prices of gas and oil,” says Kreamer.

SunRun’s offering was attractive enough to entice US Bancorp Community Development Corp. (USBCDC) to step up as an investor in November, well after it seemed that no one had any more appetite for the solar investment tax credit.

“There was a consideration of whether or not we wanted to participate in SunRun, as it did require a sizeable down payment. But our experience with SunRun is most excellent, they really know what they are doing. They are willing to work with people to get around the full amount,” says Matt Philpott, vice president of new markets and renewable investments. “We don’t have a preference for residential leasing, we are interested in commercial as well. I don’t think we have any more residential programs in the works, but we are open to more.”

The elimination of the US $2,000 cap on the tax credit for residential solar systems on January 1 has given an extra boost to traditional sales, says Jon Guice, head of research for AltaTerra.

“All residential is doing well. Installers all over the country are reporting a big backlog, due primarily to the elimination of the US $2,000 cap.”

But the interest in leasing and PPA continues. Solar City’s Rive says that before the tax credit cap was eliminated, Solar City’s business was 90%-95% SolarLease, and now it is 80%-85%, as cash sales are doing better. “The Lease is just as attractive as it was before, but cash purchases are more attractive in 2009 than in 2008, so we are seeing an uptick in interest because we have the full 30% tax credit,” he says.

Contact: Ms.Tracy

Phone: 86-15952001779

E-mail: tracyfu999@outlook.com

Whatsapp:86-15952001779

Add: No.49, Zhongshan North Road, Nanjing, China

We chat